Introduction

The practice of lending a corporation or an investor a stock, bond, or derivative as part of securities lending is known as "securitization." To get the borrowed security, the borrower must provide some collateral. The following are examples of acceptable kinds of collateral: cash, bonds, shares, and letters of credit (LOC).

In a securities lending agreement, the terms and conditions of a security lending loan are spelled out. The agreement requires the borrower to provide collateral in the form of cash, securities, or a line of credit (LOC) with a value equal to or greater than the total amount of the loan. The borrower of the security is responsible for making consistent payments of lending fees to the lender. Additionally, the borrower is expected to repay the security on the date previously agreed upon or when the lender requests it.

Example Of Securities Lending

For the sake of argument, let's imagine that a trader believes the price of a stock will fall from $100 today to $75 tomorrow. The stock price almost stays within relatively tight ranges, and investors generally view it as a stable investment. With this idea in mind, an investor goes to a securities firm and borrows fifty shares of the company, which he then sells for five thousand dollars (fifty shares times the current price of one dollar each).

If the share price falls to $75, the investor will purchase 50 shares at the lower price and then sell them back to the securities company for $3,750 (50 shares x $75 price). In this scenario, the profit from the short sale is $1,250 ($5,000 minus $3,750). To our regret, short sales do not always result in successful transactions. If an investor sells stock short with the expectation that its price will drop, but the stock increases in value instead, the investor will suffer a loss.

How Does It Work?

A borrower can obtain access to a lender's ownership in security through a practice known as securities lending. This involves the borrower providing the lender with collateral in the form of shares, bonds, or cash. The borrower commits to repay the principal amount of the loan in addition to any accrued interest at the lender's request or after the loan term, whichever occurs first. The lender has the right to receive any advantages connected to the security until the loan has been repaid in full. Any interest or profits collected will be given to the original creditor. In lending agreements, the term "collateral" refers to the property or other asset that a borrower pledges to provide to a lender as a kind of security for the repayment of a loan.

Why Would You Lend?

If you borrow money and put up collateral, you will still have the right to vote on significant items about the company. You also keep the right to receive any dividends on securities you have borrowed, but you will not have a vote at any shareholder meetings the company holds.

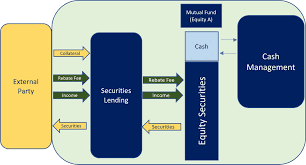

What Does A Transaction Involving The Loan Of Securities Look Like?

The following diagram outlines the steps involved in a typical transaction involving a loan on securities. The borrower gives the lender cash, and the lender gives them Bond A in exchange for the cash. After that, the lender "reinvests" the cash collateral it has received in the borrower in exchange for securities collateral. These assets may include stocks, bonds, or other financial instruments. When Bond A is returned to the lender, and the borrower additionally makes the agreed-upon cash payment to the lender, all of the other components of the transaction are likewise reversed, including but not limited to:

Things You Didn't Know About Securities Lending

Securities lending is one method you can use to produce alpha and profit from the unrealized potential of your portfolio. Lending can be lucrative, but your ability to do so will be contingent on how liquid your assets are. The returns on the more widely traded equities, sometimes known as "generic collateral," are generally lower and hover around 0.5%. (50 bps). Since all other factors are constant, securities lending has a negative beta to market swings.

A bull market in the stock market is favorable for investors since it results in bigger gains, cheaper interest rates, and less competition for loans secured by stocks. The increased demand for stock loaning during a bear market or whenever stock values fall leads to an increase in interest rates. During these unsettling times, it will be helpful to have this additional source of income to help cushion the impact.

What About The Risks?

When the lender attempts to invest the collateral monies, it suffers a financial loss. The borrower is given possession of the securities used as the basis for the loan before receiving the collateral. The legal arrangement between the lender and the borrower does not provide full protection if the borrower is in default on a loan. If an investment does not perform as predicted or unforeseen events occur, fund managers face various risks, including ethical and reputational dangers, all of which need to be considered.

Conclusion

Securities lending refers to the process in which one person or organization lends securities to another person or organization. The practice of lending out one's assets is essential to the success of a wide variety of trading strategies, including hedging, arbitrage, and short selling. When customers borrow assets from brokerage firms, they are often required to pay not just a loan fee but an interest rate, both of which are subject to change based on the kind of securities being borrowed. The lender of the security is compensated with an incentive in return.